It’s clear that 2023 was the year of artificial intelligence (AI), an excitement over technology not seen since the internet’s early years. That frenzy helped catapult such AI stocks as Nvidia some 240% higher and into the tiny and exclusive club of companies with a market capitalization over $1 trillion.

Fellow technology giant Meta Platforms (NASDAQ: META) is no slouch. Shareholders should be pleased after the stock rallied 200% over the past year. Yet, investors still might be overlooking the stock’s potential in 2024.

Meta, worth just over $900 billion today, is knocking on the trillion-dollar door that Nvidia recently walked through. Below, I’ll show why Meta will likely be worth well beyond $1 trillion this year.

Meta’s business went back to the future

Meta was once thought washed-up, a narrative that now seems like forever ago. Its shares plunged as low as $89 in 2022. Aggressive spending on the business, without any up-front return on investment, had soured Wall Street on Meta’s prospects.

CEO Mark Zuckerberg quickly righted the ship, cutting costs to get Meta’s financials back in line. Significant layoffs, cost-cutting, and offsetting soft ad pricing with increased volume helped turn free cash flow and revenue growth back in the right direction.

Sometimes, it’s as simple as a picture. You can see that Meta’s cash flow and share price have fallen and recovered right back to where they once were. In other words, Meta’s remarkable run came more from a drastic business rebound than excitement over something new, like AI.

The new narrative in 2024 is AI

But that distraction from new narratives could be precisely why Wall Street has overlooked Meta — yes, I’m saying overlooked despite a 200% share price increase. You see, Meta is becoming an AI powerhouse. It’s among the most deep-pocketed tech companies, spending tens of billions of dollars each year building out servers and resources for AI and other high-compute workloads.

Meta has implemented AI into its core business. For example, companies advertising on Meta’s apps, like Facebook and Instagram, can use its AI tools to create and target their content. Meta also has an entire division dedicated to AI, building projects that could translate cross-language conversations in real-time; for instance, Llama 2, a large language model similar to Chat GPT, and various immersive technologies for Meta’s augmented reality brand, Quest.

AI isn’t Meta’s core business, but it could soon find its way throughout its DNA, enhancing its existing businesses and helping it build new opportunities.

Is Meta still underrated?

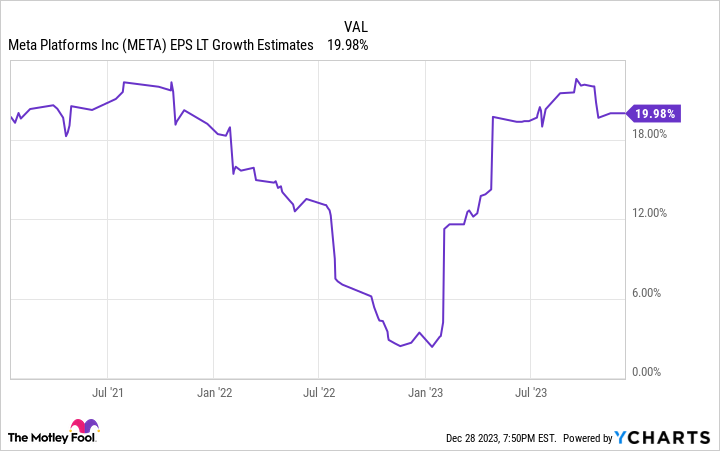

To this point, Meta has been more story than numbers, so let’s put some numbers to the stock. Meta’s rebounding financials and long-term AI potential have lifted analysts’ sentiments about the company’s growth. Today, consensus estimates call for earnings growth averaging 20% annually. As you can see, that’s a big improvement from when sentiment bottomed a year ago.

Despite its 200% gains, the stock trades at a forward price-to-earnings (P/E) ratio of 25 based on 2023 earnings estimates. It’s a reasonable P/E ratio for a company growing at 20%. That’s a price/earnings-to-growth (PEG) ratio of just 1.25. I consider anything under 1.5 attractive. At that growth rate, investors could still reasonably expect double-digit investment returns, even if Meta’s actual performance falls slightly short of estimates.

But investors should focus more on the many opportunities ahead. Meta’s family of apps continues growing its user base, AI technology is poised to make tons of progress over the coming years, and management has shown the ability to counter-punch adversity and get the company rolling again. There’s still more to like than what’s been priced into the stock. That sets Meta up for its next step — hitting a trillion-dollar valuation and beyond.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

This Magnificent Artificial Intelligence (AI) Stock Seems Destined to Follow Nvidia to the $1 Trillion Club was originally published by The Motley Fool

Eugen Boglaru is an AI aficionado covering the fascinating and rapidly advancing field of Artificial Intelligence. From machine learning breakthroughs to ethical considerations, Eugen provides readers with a deep dive into the world of AI, demystifying complex concepts and exploring the transformative impact of intelligent technologies.