On April 11, Apple (NASDAQ: AAPL) stock popped 4.3% in a single session, the largest jump in nearly a year. However, the stock gave back some of those gains in the following sessions due to a broader market pullback and reports of lower iPhone shipments.

Here’s a breakdown of what’s moving Apple stock, where the investment thesis stands, and whether the stock is worth buying now.

AI absence

Apple has been noticeably absent from the broader tech stock, growth stock, and artificial intelligence (AI)-fueled market rally. In fact, Apple stock lost value in 2024 and has drastically underperformed the S&P 500 over the last year.

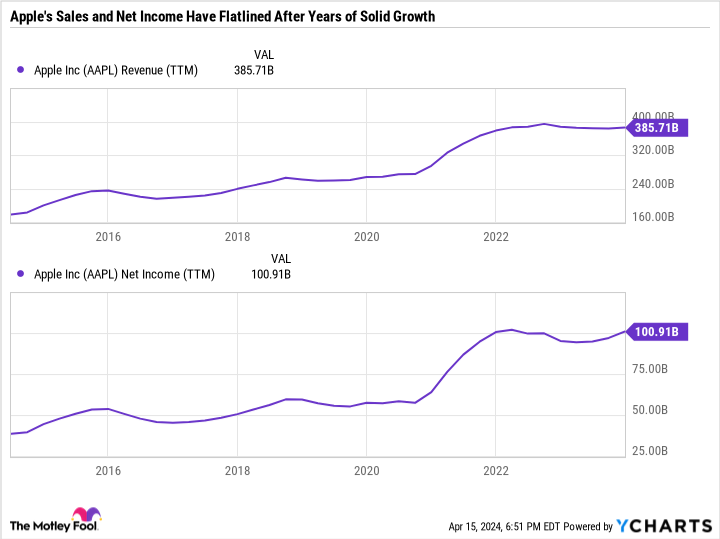

There are plenty of valid reasons for Apple’s underperformance. The primary issue is that Apple’s earnings have stalled and growth has ground to a halt.

The company has failed to make a splash in AI, while other big tech companies have been able to measure AI’s impact on their bottom lines and chart a multiyear runaway toward further AI-fueled growth. Apple’s AI and virtual reality investments, like the Vision Pro, are still in their early stages and haven’t had a material impact on the company’s performance just yet.

However, investors got a much-needed vote of confidence on April 11 when reports surfaced that Apple was nearing the production of computer processors with AI capabilities.

AI chips have been a major catalyst for semiconductor companies like Advanced Micro Devices and could help rejuvenate interest in consumer electronics. The COVID-19 pandemic pulled forward demand for Apple’s products, which boosted short-term results but led to sluggish growth in recent years. Apple needs a defining product characteristic for the next upgrade cycle since marginal product improvements haven’t been enough to spur demand meaningfully. Embedding more AI capabilities into the iPhone would be the natural way to help Apple return to growth.

Near-term challenges are heating up

As for now, Apple remains stuck in a demand slump. International Data Group (IDC) reported that Apple’s iPhone shipments fell nearly 10% in the first quarter of 2024. Apple has so far been able to offset slower demand out of China with rising or flat demand in North America and emerging markets.

Investors will have to wait until May 2 to hear from Apple about its exact second-quarter fiscal 2024 figures. However, the IDC report is concerning and illustrates the importance of Apple’s product improvements. Apple must convince investors that next-generation products will sell because they are better, not just because consumers are due for an upgrade.

Apple’s Worldwide Developers Conference from June 10 to June 14 and its annual new product unveiling event in September are the two marquee events this year. These events are good opportunities for Apple to flex its innovation. But if Apple disappoints, they could also accelerate downward pressure on the stock.

Think long-term with Apple

Apple stock has been noticeably more volatile lately. In late March, the stock suffered its largest single-session drop in over seven months, followed by its largest single-session gain in over 11 months just a few weeks later. Apple’s brand and market positioning need no introduction, but its growth is in question, especially as consumers remain strained.

With the growth narrative out the window, at least for now, Apple is starting to look more like a value stock. It is the cheapest “Magnificent Seven” stock in terms of price-to-earnings and price-to-free-cash-flow ratios. It even trades at a discount to the S&P 500.

Apple isn’t dirt cheap, but it doesn’t fetch nearly the premium as its behemoth tech peers. Investors who are confident Apple can turn things around are getting the chance to buy the stock for a good price. However, it’s important to understand that Apple has fallen for mostly good reasons and that it could fall further with a broader market sell-off.

Buying Apple now shouldn’t be a bet on the stock suddenly staging an epic turnaround, but rather a long-term investment in an excellent company that will monetize AI and has a long runway for returning value to shareholders and growing over time.

It’s worth noting that even amid slowing growth, Apple generates plenty of extra cash to continue to buy back a boatload of stock and raise its dividend. Apple is a buy for patient investors, but the stock could face pressure if its AI investments fail to deliver.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Daniel Foelber has the following options: long July 2024 $180 calls on Advanced Micro Devices. The Motley Fool has positions in and recommends Advanced Micro Devices and Apple. The Motley Fool has a disclosure policy.

Apple Just Posted Its Largest Single-Session Pop in Over 11 Months After Artificial Intelligence (AI) Update. Is the “Magnificent Seven” Stock Returning to Growth? was originally published by The Motley Fool

Eugen Boglaru is an AI aficionado covering the fascinating and rapidly advancing field of Artificial Intelligence. From machine learning breakthroughs to ethical considerations, Eugen provides readers with a deep dive into the world of AI, demystifying complex concepts and exploring the transformative impact of intelligent technologies.