Thomas Kramer, the Chief Financial Officer of IonQ Inc, has recently made a significant change in his investment portfolio by selling 28,190 shares of the company. This move, executed on December 11, 2023, has caught the attention of investors and market analysts alike, prompting a closer examination of the insider trading dynamics at IonQ Inc.

Who is Thomas Kramer of IonQ Inc?

Thomas Kramer serves as the Chief Financial Officer (CFO) of IonQ Inc, a position that places him at the financial helm of the company. As CFO, Kramer is responsible for overseeing the financial operations, risk management, and fiscal planning of the organization. His role is crucial in shaping the company’s financial strategy and ensuring its economic stability and growth. Kramer’s decisions and actions, including his trading activities, are closely monitored by investors as they can provide insights into the company’s internal perspective on its financial health and future prospects.

IonQ Inc’s Business Description

IonQ Inc is at the forefront of quantum computing, a cutting-edge field that promises to revolutionize the way we process information. The company specializes in the development of quantum computers designed to solve complex problems much faster than traditional computers. IonQ’s technology leverages the unique properties of quantum mechanics to perform computations that are currently beyond the capabilities of classical computing systems. As a pioneer in this space, IonQ Inc is working towards making quantum computing accessible and practical for a variety of applications, including drug discovery, materials science, and optimization problems.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, particularly those of high-ranking executives like CFOs, are often considered a barometer for a company’s financial health. When an insider sells a substantial number of shares, it can signal a lack of confidence in the company’s future performance or a belief that the stock is currently overvalued. Conversely, insider purchases might indicate that the insider believes the stock is undervalued or that strong performance is on the horizon.

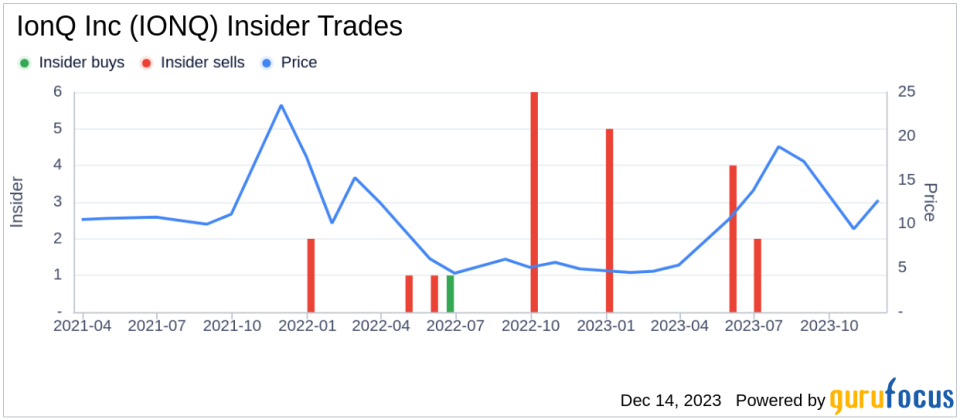

In the case of IonQ Inc, the insider transaction history over the past year shows a notable absence of insider buys, with a total of 0 purchases. On the other hand, there have been 7 insider sells during the same period, suggesting that insiders might be taking a cautious stance towards the company’s stock. Thomas Kramer’s recent sale of 28,190 shares adds to this pattern of insider selling.

On the day of Kramer’s sale, IonQ Inc’s shares were trading at $13.21 each, valuing the company at a market cap of $3.021 billion. This valuation places IonQ Inc in the mid-cap category, which can often experience more volatility and higher growth potential compared to large-cap stocks. The relationship between insider selling and stock price can be complex, as various factors, including market conditions, company performance, and individual financial needs, can influence an insider’s decision to sell.

It is important to consider the broader context of the stock’s performance and market trends when analyzing insider trading activity. While a series of insider sales could be a red flag, it does not necessarily mean that the stock will decline. Investors should look at the company’s fundamentals, industry outlook, and other relevant data points before making investment decisions.

The insider trend image above provides a visual representation of the recent insider trading activity at IonQ Inc. The chart can help investors identify patterns and trends that may offer additional insights into the sentiment of company insiders.

Conclusion

Thomas Kramer’s recent sale of 28,190 shares of IonQ Inc is a significant event that warrants attention from the investment community. While insider selling can be interpreted in various ways, it is essential to analyze such transactions within the broader context of the company’s performance and market conditions. IonQ Inc’s position as a leader in quantum computing technology makes it an intriguing prospect for investors interested in high-growth potential stocks. However, the lack of insider buying over the past year, coupled with multiple insider sales, may suggest a cautious approach from those with intimate knowledge of the company’s operations and outlook.

Investors should continue to monitor insider trading activity, along with other financial metrics and industry developments, to make informed decisions regarding their investment in IonQ Inc. As always, a diversified investment strategy that considers multiple factors is recommended to mitigate risk and capitalize on potential opportunities in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Wanda Parisien is a computing expert who navigates the vast landscape of hardware and software. With a focus on computer technology, software development, and industry trends, Wanda delivers informative content, tutorials, and analyses to keep readers updated on the latest in the world of computing.