It’s not everyday companies turn into trillion-dollar megacaps. Microsoft (NASDAQ: MSFT), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOGL), and Apple (NASDAQ: AAPL) have all crossed that threshold and delivered big returns to investors — but they won’t be the last. If you aren’t paying attention, it’s easy to miss out on the next crop of companies that have the potential to join the trillion-dollar market cap club. The following three stocks have the growth profiles, size, and competitive advantages that will likely propel them into this rarified club within the next decade.

1. Salesforce

Salesforce (NYSE: CRM) dominates the customer relationship management (CRM) software industry, dwarfing its closest competitors in market share. Salesforce has become a standard tool for professionals in customer-facing roles, and its product suite is a trusted resource to improve the efficiency and overall performance of sales te ms. The company has built a wide moat based on high switching costs and a network effect, solidifying its competitive position.

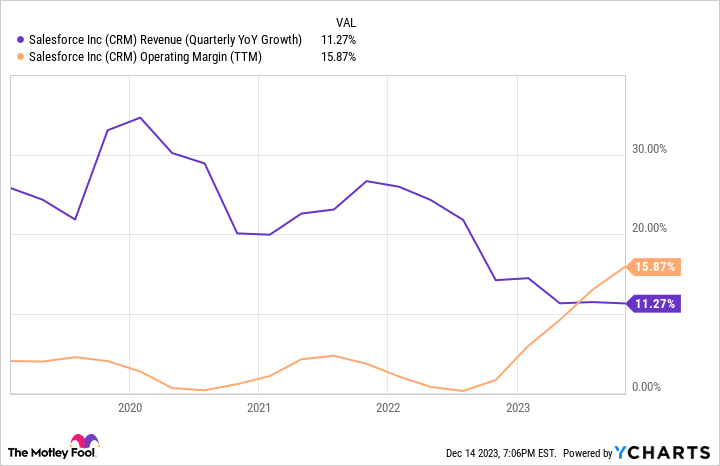

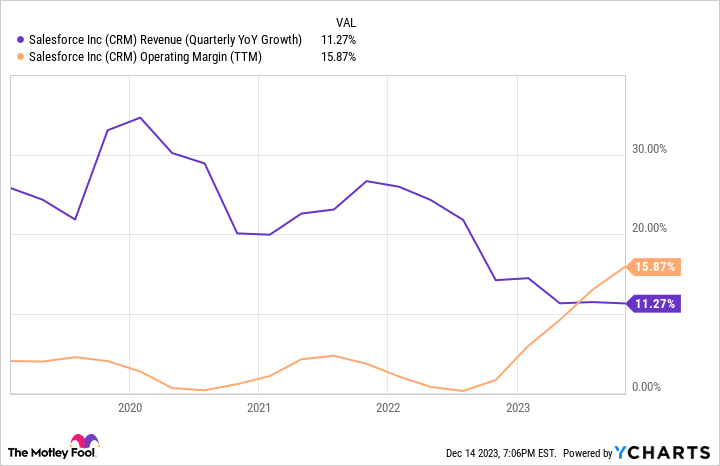

Salesforce is transitioning to a new era as it matures amid global macroeconomic weakness. The company’s growth rate has been slowing, and it has shifted focus toward profitability by managing operating expenses. That’s been a common theme among tech companies over the past year.

Salesforce has adeptly managed this shift by slashing its expense budgets. This has propelled adjusted operating margins over 30%, placing the cloud software provider firmly into profitability. Salesforce expects free cash flow to grow more than 30% this fiscal year. These results clearly demonstrate that this business can produce strong cash flows, making it a less speculative investment than in previous years during its high-growth, high-burn phase. It’s still expanding at an impressive pace, and there’s a chance that it could accelerate once again when economic conditions improve. Renewed spending sales and product development could catalyze future growth, especially if AI enhancements stimulate demand for the platform.

Salesforce’s market cap is around $250 billion right now. It’s trading at a very reasonable forward price-to-earnings (P/E) ratio below 30 and a price-to-cash-flow ratio around 26. If its earnings continue to outpace sales growth, the valuation is reasonable enough for Salesforce’s market cap to quadruple over the next decade.

2. Adobe

Adobe (NASDAQ: ADBE) has enjoyed decades as one of the leading providers of creative software. Customers use the suite of tools to create digital images, videos, graphics, and documents. The company has added additional functions over the years, such as marketing, publishing, and analytics, entrenching Adobe as the market leader for content creation software.

Adobe’s 12% growth rate last year follows a similar trend to Salesforce. The company’s growth is slowing, but it’s still expanding at an impressive rate. Adobe successfully drove profit margins higher by controlling costs, and its earnings growth is outpacing revenue. The company is delivering close to 35% operating margin, and it’s an excellent cash flow generator.

AI presents both potential threats and opportunities for Adobe. The company has invested heavily in AI capabilities for years, which have been weaved increasingly into its product suite to support digital creators in new ways. However, there are concerns that AI could change the competitive landscape and ultimately hurt demand for Adobe products. That creates uncertainty for investors, but it also prevents upside.

Adobe’s market cap is around $275 billion, with a forward P/E ratio of 30. If the company’s offering isn’t deeply disrupted by the proliferation of AI, it’s a strong candidate to surpass $1 trillion in market cap over the next few years.

3. ServiceNow

ServiceNow (NYSE: NOW) provides a popular IT workflow platform with excellent traction among large enterprise customers from all industries. It’s become an integral part of operations and effective digital transformation for nearly 1,800 companies. Its product quality and deep penetration of its target market have secured ServiceNow’s place at the table for years to come.

Recent results have been highly encouraging. ServiceNow reported 25% revenue growth last quarter, along with nearly $200 million in free cash flow. The company’s profit growth is outpacing sales thanks to discipline on operating expense budgets and economies of scale. ServiceNow also boasts a 98% customer retention rate, which indicates high customer satisfaction and effective sales processes. These are the exact features that investors should identify in stocks with sustainable growth catalysts.

ServiceNow’s forward P/E ratio is close to 60, so it’s a bit more expensive than the other stocks covered above. Its high growth rate and cash flow generation command a premium, so it’s no shock that the stock has pricier valuation ratios. Even with aggressive expectations to meet, ServiceNow’s outlook creates the opportunity for its market cap to grow from $140 billion today. It has a longer way to go than Adobe or Salesforce, but a couple more years of strong execution should help it close that gap.

Should you invest $1,000 in Salesforce right now?

Before you buy stock in Salesforce, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Salesforce wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Downie has positions in Alphabet, Microsoft, Nvidia, and Salesforce. The Motley Fool has positions in and recommends Adobe, Alphabet, Apple, Microsoft, Nvidia, Salesforce, and ServiceNow. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

3 High-Growth Stocks That Could Be Worth $1 Trillion in 10 Years — Or Sooner was originally published by The Motley Fool

Wanda Parisien is a computing expert who navigates the vast landscape of hardware and software. With a focus on computer technology, software development, and industry trends, Wanda delivers informative content, tutorials, and analyses to keep readers updated on the latest in the world of computing.