-

Robust financial performance with significant net earnings growth.

-

Strategic focus on edge-to-cloud solutions driving market differentiation.

-

Challenges in supply chain management and competitive pressures.

-

Opportunities in high-performance computing and AI integration.

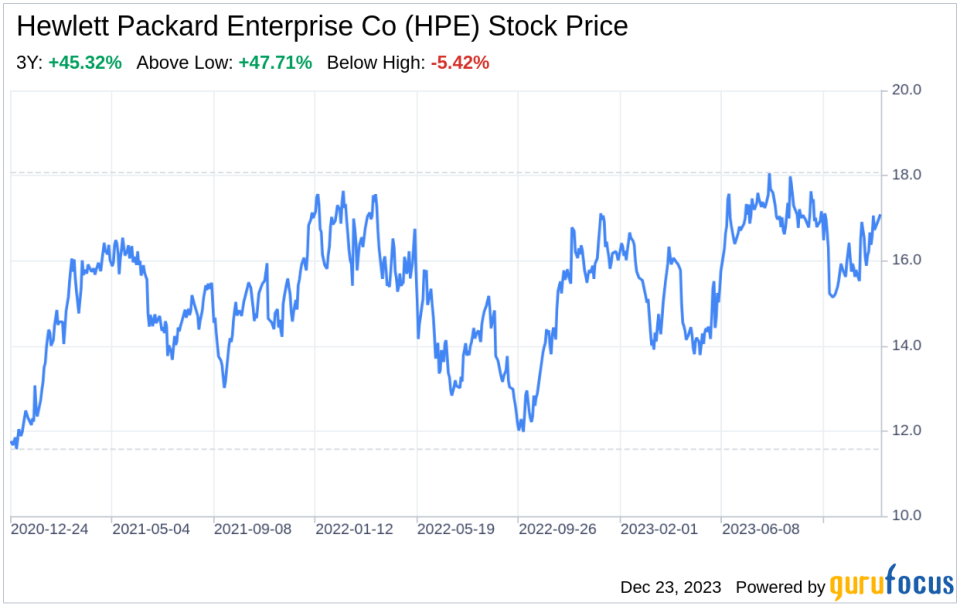

On December 22, 2023, Hewlett Packard Enterprise Co (NYSE:HPE) filed its 10-K report, revealing a year of substantial financial growth and strategic positioning. HPE, a leading information technology vendor, reported net earnings of $2,025 million for the fiscal year 2023, a considerable increase from $868 million in 2022. This growth is a testament to the company’s resilience and its strategic initiatives to become a comprehensive edge-to-cloud platform provider. With a diverse product portfolio that includes compute servers, storage arrays, networking equipment, and a burgeoning high-performance computing business, HPE continues to leverage its primarily outsourced manufacturing model to serve a global customer base. The company’s market capitalization stood at $18,427 million as of April 30, 2023, reflecting investor confidence in its business model and future prospects.

Strengths

Financial Performance and Brand Reputation: HPE’s financial health is robust, with a significant increase in net earnings from $868 million in 2022 to $2,025 million in 2023. This financial strength is underpinned by a total net revenue of $29,135 million for the fiscal year 2023, demonstrating the company’s ability to generate revenue and effectively manage its operations. HPE’s brand, built on a legacy of innovation dating back to 1939, continues to be a major asset. The brand’s reputation for quality and reliability has helped HPE maintain a loyal customer base and attract new clients, particularly in the enterprise sector.

Innovative Product Portfolio: HPE’s product lines are well-regarded in the industry, with its compute servers, storage arrays, and networking equipment being integral to the IT infrastructure of numerous organizations. The company’s focus on high-performance computing and AI solutions positions it at the forefront of emerging technological trends, catering to the growing demand for advanced data processing capabilities. HPE’s strategic investments in R&D, as evidenced by its Hewlett Packard Labs, fuel continuous innovation and maintain its competitive edge.

Weaknesses

Supply Chain Vulnerabilities: Despite its financial success, HPE’s reliance on an outsourced manufacturing model exposes it to supply chain vulnerabilities. The global nature of its operations means that disruptions in one region can have cascading effects on production and delivery timelines. This was highlighted in the recent supply chain constraints, which, although easing, continue to pose a risk to HPE’s ability to meet customer demand promptly.

Competitive Market Pressures: HPE operates in a highly competitive market, with numerous players vying for market share in the IT infrastructure space. The company must continuously innovate and adapt to maintain its position, which requires significant investment in new technologies and market strategies. Additionally, HPE’s financial services segment, while providing valuable investment solutions, faces competition from specialized financial institutions that could erode its market share.

Opportunities

Edge-to-Cloud Expansion: HPE’s strategic goal to be a complete edge-to-cloud company presents significant opportunities for growth. The increasing demand for hybrid cloud solutions and hyperconverged infrastructure opens up new markets for HPE’s products and services. By capitalizing on this trend, HPE can further entrench its position as a leader in providing comprehensive IT solutions that span from the edge of the network to the cloud.

AI and Data Analytics Integration: The integration of AI and data analytics into HPE’s offerings is a major opportunity for the company. As businesses seek to leverage data for competitive advantage, HPE’s solutions that facilitate data capture, analysis, and action can become increasingly valuable. The company’s investments in AI and analytics capabilities can drive new business models and customer experiences, contributing to long-term growth.

Threats

Technological Disruption: The rapid pace of technological change presents a threat to HPE’s existing product lines. Innovations such as quantum computing and next-generation networking technologies could disrupt the market, requiring HPE to invest heavily in keeping its offerings relevant. Failure to anticipate or respond to these changes could result in a loss of market share and reduced profitability.

Economic and Regulatory Challenges: Economic uncertainties, including inflationary pressures and foreign exchange fluctuations, can impact HPE’s global operations. Regulatory changes, particularly in areas such as data privacy and cybersecurity, could impose additional compliance costs or limit HPE’s ability to operate in certain markets. These factors could adversely affect HPE’s financial performance and strategic initiatives.

In conclusion, Hewlett Packard Enterprise Co (NYSE:HPE) exhibits a strong financial foundation and a reputation for innovation that positions it well in the competitive IT infrastructure market. The company’s strategic focus on edge-to-cloud solutions and high-performance computing aligns with current technological trends, presenting opportunities for growth. However, HPE must navigate supply chain complexities, competitive pressures, and the potential for technological disruption to maintain its market leadership. By leveraging its strengths and addressing its weaknesses, HPE can capitalize on emerging opportunities while mitigating threats to ensure its continued success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Wanda Parisien is a computing expert who navigates the vast landscape of hardware and software. With a focus on computer technology, software development, and industry trends, Wanda delivers informative content, tutorials, and analyses to keep readers updated on the latest in the world of computing.